Buying a Home in 2024? There Might Be Lower Mortgage Rates But More Competition. Here Are 11 Tips to Help Make It Happen!

Should you’ve but to enter the housing market, however are pondering of shopping for a house in 2024, there’s quite a bit it’s good to know. The 2024 housing market goes to be quite a bit totally different than in prior years!

As I as soon as identified, this isn’t your older sibling’s housing market. Not simply anybody can get a mortgage lately. You really need to qualify. However we’ll get to that in a minute.

Let’s begin by speaking about house costs, which surged in recent times and are lastly starting to maneuver sideways after hitting all-time highs.

On the identical time, mortgage charges stay fairly elevated, having greater than doubled from their document lows over the course of 2022 and 2023, although they’re slated to fall because the yr goes on.

Taken collectively, house shopping for in 2024 ought to get a little bit simpler from an affordability standpoint, however it nonetheless isn’t low-cost and high quality stock stays scarce.

1. Put together for Extra Sticker Shock When Shopping for a Dwelling in 2024

Should you’re making ready to purchase a house in 2024, anticipate to be shocked, and never in a great way.

At this level within the cycle, house costs have eclipsed previous all-time highs in lots of components of the nation, if not practically all locations.

And whereas appreciation is now on a downward trajectory, with marginal and even barely damaging annual positive aspects anticipated, it stays constructive in most metros.

In different phrases, properties aren’t low-cost, nor do they appear to be occurring sale this yr, regardless of these excessive mortgage charges.

Whereas some markets skilled a correction in 2022 and 2023, most are slated to rise in 2024 as they’ve in prior years, albeit at a slower tempo.

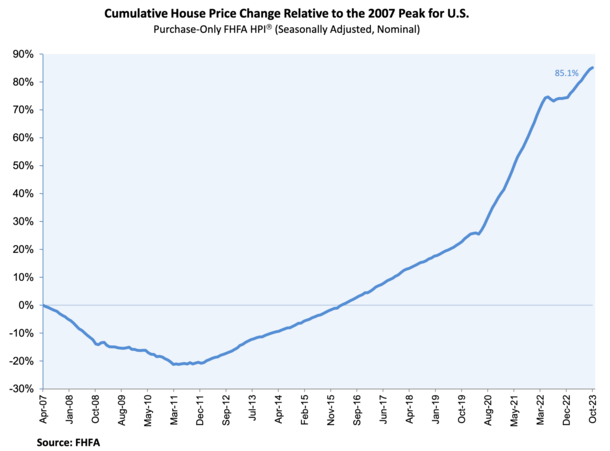

Trying on the graph above from the FHFA, you may see that after a minor blip, costs marched larger and left their 2007 peak within the mud.

Many consider mortgage charges and residential costs have an inverse relationship, however this merely isn’t supported by the information. Each can go up (or down) collectively.

Earlier than the pandemic-fueled loopy vendor’s market received underway, you possibly can typically anticipate to pay beneath the Zestimate/Redfin Estimate. Actual property brokers even used to cover them!

Then it was all bidding wars and gives of $100,000 or extra above asking in scorching markets.

These days, there’s a superb probability bids barely beneath asking will once more be accepted by extra real looking sellers, however you’ll want to have a look at the place costs had been only a couple years in the past.

Take a look at that property historical past part on Zillow or Redfin. What did they purchase it for and when? Are they promoting it for double the value after only a few years?

Is it really a screaming discount? Or a slight low cost off what was as soon as a brilliant inflated value?

Sadly, stock stays extraordinarily tight and if charges come down there’ll possible be sturdy house purchaser demand, particularly for high quality properties in modern areas.

The unhealthy information for renters is house costs are nonetheless projected to rise 2.5% on a year-over-year foundation from November 2023 to November 2024, per the CoreLogic HPI Forecast.

Briefly, anticipate to shell out a variety of dough if you need a house this yr, even when paying beneath asking (or getting a reduction vs. 2022 highs).

The mix of a considerably larger mortgage fee and a still-high asking value are sufficient to maintain sticker shock alive and properly in 2024.

However if you happen to completely love the property, it is perhaps a small value to pay to lastly put a irritating house search to relaxation.

The previous marry the home, date the speed adage might start to make extra sense if charges really do fall decrease in late 2024 and 2025.

2. Get Pre-Authorised for a Dwelling Mortgage Early On

Talking of that house nonetheless being out of your value vary, you might wish to get pre-approved with a financial institution, mortgage dealer, or mortgage lender ASAP.

First off, actual property brokers received’t provide the time of day with out one, although the market has cooled.

And secondly, if you happen to don’t understand how a lot home you may afford, you’re principally losing your time by perusing listings and going to open homes.

That is very true if mortgage charges creep again up as it can additional erode your buying energy. Both approach, take the time to know the place you stand. Don’t be complacent, even when others are.

It’s not exhausting or all that point consuming to get a mortgage pre-approval, and it’ll offer you extra confidence and maybe make you extra critical about lastly making the transfer.

Learn extra about why you need to search for a mortgage earlier than you seek for a house.

Tip: Search for a web based mortgage lender that allows you to generate a pre-approval on the fly in minutes (and know you don’t have to make use of them if and once you proceed with a house buy!).

3. Verify Your Credit score Scores and Put Away Your Credit score Playing cards

Whilst you’re at it, you need to test your credit score scores (all 3 of them) and decide if something must be addressed. NOW!

As I at all times say, credit score scoring adjustments can take time, so give your self loads of it. Don’t wait till the final minute to repair any errors or points.

And when you’re addressing something that wants extra consideration, do your self a favor and put the bank cards within the freezer (or some other place out of attain).

Chances are high you’ve racked up some spending through the holidays, so it’s time to begin paying it off.

Plenty of spending, even if you happen to pay it again immediately, can ding your scores, even when simply momentarily.

This has grow to be much more necessary as a result of Fannie Mae and Freddie Mac now need debtors to have a 780 FICO rating for the perfect pricing.

Excellent debt may also improve your DTI ratio and restrict your buying energy if you happen to don’t pay it off. In the end, unhealthy timing can create huge complications within the mortgage world.

As well as, pumping the brakes on spending may offer you a pleasant buffer for closing prices, down cost funds, shifting prices, and renovation bills when you do purchase.

Talking of belongings, cease messing with them and hold them in a single account that may be simply verified when you apply for a house mortgage.

This implies no incoming or outgoing transfers apart from direct deposits out of your job. A cleaner financial institution assertion will make life quite a bit simpler for everybody, together with your underwriter!

4. High quality Housing Stock Will Be…Restricted

It’s the identical story in 2024 because it was in 2023, 2022, 2021, and heck, even way back to 2012.

There’s been an absence of stock for the reason that housing market bottomed as a result of properties had been by no means on the market en masse.

That is the true cause behind the document house value progress seen in recent times. The low mortgage charges simply added gas to the hearth.

In the course of the prior housing disaster, debtors received foreclosed on or deployed actual property brief gross sales to maneuver on, and banks made certain all that stock by no means flooded the market.

Others rode it out and at the moment are in unimaginable positions with tons of house fairness simply ripe for the tapping.

Right this moment, we’ve received tens of millions of would-be sellers with nowhere to go, due to the huge value will increase realized over the previous few years.

And the lock-in impact of low mortgage charges they don’t wish to go away behind.

In the end, it’s exhausting to maneuver up or downsize, so a variety of people are staying put. Meaning much less alternative for you.

Whereas we are going to see an uptick in stock in 2024 due to impatience and decrease rates of interest, the housing provide remains to be extremely low traditionally.

On the finish of November, the Nationwide Affiliation of Realtors mentioned unsold stock was at a 3.5-month provide on the present gross sales tempo, down from 3.6 months in October and up barely from 3.3 months a yr in the past.

This stays beneath the 4-5 months of provide thought-about wholesome. So mortgage charges apart, we are going to proceed to have a provide/demand imbalance.

The caveat is new properties is perhaps in larger provide due to elevated constructing, although they’re typically in less-central places the place uncooked land was extra available to house builders.

With falling mortgage charges and plenty of People hitting the ripe first-time purchaser age of 34, anticipate competitors to accentuate because the yr goes on, even when not as unhealthy as latest years.

Once more, this helps the argument of being ready early so that you’re able to make a suggestion at a second’s discover!

5. The Dwelling You Purchase May Be a Fixer Higher

You in all probability don’t have the identical talent set as Joanna and Chip Gaines, however you may nonetheless wind up with a fixer-upper due to these large stock constraints. And that’s completely okay.

What I’ve discovered from shopping for actual property is that you’ll usually by no means be content material with the upgrades earlier homeowners or builders make, even when they had been tremendous costly and prime quality. So why pay further for it?

Particularly if the house comes adorned with grey flooring and different tendencies which might be quickly going out of fashion.

There’s a superb probability you’ll wish to make the house yours, with particular touches and adjustments that distance your self from the earlier proprietor.

Don’t be afraid to go down that street, but in addition know the distinction between superficial blemishes and design challenges, and main issues.

Particularly this yr, be careful for cash pits that sellers are desperately trying to unload as a result of they missed the highest of the market might now be panicking.

These properties that might by no means promote might hit the market once more, however you won’t need that purchaser to be you.

With extra stability within the housing market, and fewer strain to waive contingencies, take the time to get a correct house inspection (or two) and go to the inspection your self!

6. You’ll Could Nonetheless Must Battle for the Property

What’s much more annoying is that you’ll have to battle to get your fingers on the few high quality properties which might be on the market, relying on the housing market in query.

I used to be talking with my endodontist (sure, endodontist) the opposite day and he introduced up a superb level.

Having had bought a property a yr or so in the past, he talked about how at this time’s house consumers are more and more determined.

So if and once they do come throughout one thing they even remotely like, they’re prepared to go above and past.

And which means even when 2024 is a cooler housing market, scaring off different would-be consumers within the course of.

If the property is fashionable, there’ll at all times be somebody prepared to outbid you for that house they only will need to have. That is another excuse why the fixer could be a winner, the hidden gem if you’ll.

That being mentioned, it’s okay to pay full ask (and even the totally appraised worth), simply needless to say there are many different fish within the sea.

Effectively, maybe not a lot proper now, however there’s at all times one other alternative across the nook.

Keep poised and don’t let your feelings get one of the best of you. Like anything, it’s okay to stroll away. Belief your intestine.

7. Completely Negotiate with the Dwelling Vendor (and Actual Property Agent)

It appears clear that 2024 is not going to be an outright vendor’s market once more, because it had been for the previous decade previous to final yr.

That is in all probability the second yr in a row the place we’ll see some equilibrium in that respect.

So even in fashionable markets, you’ll be capable of negotiate on value, contingencies, repairs, and so on.

Whilst you’re at it, negotiate the fee your actual property agent expenses. Whereas it by no means hurts to ask, your possibilities of success could possibly be higher in 2024 due to ongoing fee lawsuits.

On the identical time, it’s nonetheless doable you possibly can get right into a bidding struggle. If that occurs and also you win the factor, you’ll want to examine the heck out of the home.

Inspections are key to figuring out what is going to have to be addressed as soon as the house adjustments fingers, and what the vendor might want to do to compensate you for these points.

Certain, the vendor might say it’s being bought as-is, however you may nonetheless say what about this, that, and that different factor?

Should you don’t get a high quality inspection (or two), you’ll have a troublesome time asking for credit for closing prices or perhaps a decrease buy value. Take it very severely, the return on funding might be staggering.

Additionally know that in some markets nationwide, consumers might have the higher hand in 2024.

Plenty of native actual property markets have cooled considerably, so that you may be capable of bid beneath asking AND nonetheless get cash for repairs.

You must also inquire about vendor concessions, and a doable mortgage buydown to snag a decrease fee the primary 1-3 years on your property mortgage.

Take a second to raised perceive your goal market by lately closed listings on web sites like Redfin and Zillow. Verify what they initially listed for and ultimately bought for.

In the event that they’re constantly promoting beneath checklist, you recognize it’s going to be a comparatively simple purchase. If not, properly, get your negotiating hat on.

The highest 10 2024 housing markets embrace Toledo, Oxnard-Thousand Oaks-Ventura, Rochester, San Diego, Riverside-San Bernardino, Bakersfield, Springfield and Worchester (MA), Grand Rapids and even Los Angeles, per Realtor.

In locations that had been beforehand scorching, like Austin, Boise, Las Vegas, and Phoenix, offers is perhaps simpler to return by. Simply be careful for falling house costs after you purchase. Some metros could possibly be prone to cost declines.

8. All the time Do Your Mortgage Homework

Whilst you might need your fingers full with an overzealous actual property agent, it’s necessary to not neglect your property mortgage.

Mortgages are sometimes simply mailed in, with little consideration given to the place they’re originated, or what value is paid.

Your actual property agent can have their most popular lender that you simply “actually ought to think about using as a result of they’re one of the best,” however you don’t have to make use of them and even converse to them.

I’ll usually say get a quote from them as a courtesy to maintain issues amicable, and to appease your agent, but in addition store round with different banks, credit score unions, lenders, and mortgage brokers.

On the identical time, take into consideration the way you wish to construction the mortgage, together with down cost, mortgage sort (FHA or typical), and mortgage program.

The 30-year fastened isn’t at all times a no brainer, although you may be capable of get a free buydown from the lender (Inflation Buster) or vendor that makes it low-cost for a pair years (or the lifetime of the mortgage).

There are different mortgage applications that may make sense too, such because the 5/1 ARM, which regularly get swept below the rug. You should definitely make the selection your self.

Additionally hold a really shut eye on charges and fee as mortgage lenders are charging a number of low cost factors lately in an unsure mortgage fee surroundings.

Watch out paying mortgage low cost factors as charges are anticipated to go down this yr and subsequent. And you possibly can go away cash on the desk if you happen to refinance earlier than recouping the upfront price.

9. Anticipate a Higher Mortgage Charge Than Final 12 months

Should you’ve accomplished your homework and are in good monetary form, you need to be capable of get your fingers on a good mortgage fee in 2024.

In actual fact, mortgage rates of interest are traditionally “not unhealthy” for the time being, regardless of doubling over the previous couple years.

Certain, your fee might begin with ‘6’ as a substitute of ‘3’ however that’s life. And a low 6% 30-year fastened remains to be a reasonably whole lot, particularly if you happen to’re in a position to get the property for 10-20% off its latest highs.

It must also be markedly higher than the 8% mortgage charges on provide in 2023.

The 2024 mortgage fee forecast appears to be like principally favorable, so we might even see some reduction because the months go by, with charges presumably within the low 5% vary sooner or later.

By way of financing, it’s nonetheless an OK time to purchase a house. However when you issue within the sky-high costs, the argument to hire vs. purchase begins to sound intriguing in some markets.

Both approach, be further prudent in terms of deciding on a lender to make sure you get one of the best fee and the bottom charges, even when charges proceed to fall.

In the mean time, there may be a variety of divergence in pricing among the many lenders nonetheless working, so store judiciously.

10. The Greatest Time to Purchase May Be Later within the 12 months

Earlier than you get too excited watching house costs cool and mortgage charges trickle again down, it’d really be in your favor to gradual play this one.

Per Zillow, one of the best time to purchase a house could also be in late summer season, together with the months of August and September.

Mainly, you’ve received the gradual, chilly months initially of the yr the place there isn’t a lot stock, adopted by the sturdy spring housing market the place everybody and their mom abruptly desires to purchase.

That is usually when asking costs peak through the yr and in addition when mortgage charges are highest.

You then get a lull and maybe a dip in house costs throughout summer season, which could possibly be a horny entry level.

You may even get fortunate and snag an enormous value minimize with quite a bit much less competitors whereas different potential consumers are on trip.

The icing on the cake is that mortgage charges are anticipated to fall extra within the second half of the yr, so that might double your potential victory.

In my 2024 housing market predictions submit, I famous that house costs and charges might each fall later within the yr.

Regardless, get pre-approved NOW and arrange your alerts for brand new listings ASAP and simply be able to pounce every time. Don’t try and time the market ever!

11. Are You Truly Certain You Wish to Purchase a Dwelling?

Lastly, take a second to make sure you really wish to purchase a house versus persevering with to hire.

I always hear the previous “throwing away cash on hire” line and it by no means will get previous. Then I proceed to fantasize about renting with not a care on the planet.

Are you certain you’re throwing away cash on hire? Renting might be fairly superior.

You don’t pay property taxes, owners insurance coverage, HOA dues, PMI, or mortgage curiosity. And you’ll go away everytime you need. That feels like a candy deal too.

Oh, and if something goes fallacious, you may simply name your landlord or property administration firm. Straightforward peasy.

With a house, the issue is yours, and yours alone to cope with. Damaged water heater? You’re paying 1000’s out of pocket, not the owner.

And with house costs so excessive, watch out to not grow to be home poor in trade for getting into the housing market. Ensure you’ve received reserves readily available if and when stuff goes fallacious.

It’s not exhausting to overextend your self in at this time’s housing market, so ensure you’ve received an emergency fund after paying all of your closing prices.

Watch Out for the Presidential Election and a Potential Recession in 2024

One further factor to think about given the continued COVID-19 pandemic that reared its head a couple of years in the past and the huge inflation that got here with it. There is perhaps a recession in 2024…

Sure, we heard this in 2023 as properly and it didn’t materialize. At the moment, economists believed there was a 70% probability of a recession.

The chances of a recession for 2024 have since fallen to roughly 52%, per Statista, which quantities to a coin flip.

This will impression your determination to purchase a house, with maybe the most important situation being doable unemployment.

There have been a variety of layoffs these days, and there are in all probability much more within the pipeline, sadly.

These prone to job loss clearly need to be tremendous aware a few potential house buy. Ensure you’re in a superb place to make that huge monetary step.

Throughout recessions, house costs don’t essentially go up or down, however gross sales quantity typicallys drop as homeowners hunker down. Since they’re already hunkered down with their low charges, it might additional squeeze provide.

With regard to financing, mortgage charges are likely to fall throughout recessions, which could possibly be a silver lining.

And let’s not overlook the 2024 U.S. presidential election. There may be a variety of uncertainty surrounding it, and that might present some surprising twists for the housing market.

Each of those occasions must be taken very severely, and supply yet one more layer of stress to the house shopping for course of.

In the end, you need to at all times give a house buy a ton of thought, so for me not a lot has modified on this entrance.

It doesn’t essentially need to be placed on maintain, however it may require extra analysis given the elevated uncertainty with the economic system, demographic shifts (metropolis vs. suburban residing), and so forth.

Additionally, suppose earlier than you make an entire way of life change like shifting out of the town and into the nation, simply because it’s on-trend. You may look again in a yr or two and say what was I pondering?! Ever seen Humorous Farm?

I consider the 2024 housing market will probably be a little bit brighter in comparison with 2023, however nonetheless difficult.

This implies extra house gross sales and higher equilibrium for consumers and sellers with barely decrease mortgage charges. However nonetheless a dearth of high quality provide.

In different phrases, shopping for a house in 2024 will stay costly, although newly-built properties is perhaps considerably of a deal if house builders proceed to supply huge concessions.

Should you’re questioning if 2024 will probably be a superb yr to purchase a home, that’s one other query.

I anticipate costs to stage off this yr and doubtlessly stay flat for the foreseeable future. They might even go down on a nominal foundation. The appreciation occasion has actually come to an finish.

So anticipating huge positive aspects anytime quickly after buy is perhaps a tad optimistic. Extra possible would be the probability to refinance to a decrease fee to save lots of in your mortgage.

Learn extra: When to search for a home to purchase.

[ad_2]